About myself: I am the architect and the project lead of Lendroid. Previously, I co-founded Bitaccess (a YCombinator backed Bitcoin ATM company, based in Ottawa, Canada) in 2013, scaled the BTM(bitcoin ATMs) network from 0 to 100. I designed Velocity, even though I decided to shut it down for reasons listed here, the project made me greatly understand the legal, crypto economic, technical and structural aspects of an open protocol project. We are at the beginning of a paradigm shift. December 2016, I decided to step down from my operational role at Bitaccess to dedicate my time to working on open protocols.

I am happy to introduce Lendroid, a decentralized digital asset lending protocol and platform.

Twitter: https://twitter.com/lendroidproject

Whitepaper: https://lendroid.com/assets/whitepaper.pdf

Pitch deck: https://lendroid.com/assets/lendroid-pitch-deck.pdf

Slack: http://slack.lendroid.com

Blog: https://blog.lendroid.com

Email: connect@lendroid.com

There is a need, and there will be a greater need for borrowing funds for short term not by pawning physical gold or a house but by pawning a digital asset.

Imagine opening a mobile app, depositing 20 REP / 10 MKR tokens and receiving 5 ETH / 100 USD-DC into your account that you can spend immediately. You pay back 5.01 ETH / 101 USD-DC in 10 days and receive your 20 REP / 10 MKR deposit back.

Individuals/Organizations can use Lendroid to raise funds as debt, leverage a trade position, avail a short term ‘payday loan’ style advance and more. No identity required and all on-chain without the need to trust a third party.

Lendroid is an open protocol based on the Ethereum blockchain that handles complete lifecycle of collateralized digital asset loans. Imagine ‘shapeshift’ where you deposit a token to receive another token, but with an option of getting back, the first token deposited, albeit for a short term.

Ecosystem synergy:

Lendroid makes no sense in the absence of other DApps and tokens on the Ethereum platform. But in combination with other DApps, the real power of the Lendroid can be realized. A few examples:

- Lendroid + Melon = Allows traders to leverage their positions, allows traders to hold a short position.

- Lendroid + Stabl / Decentralized capital = Allows users to avail loans against any Ethereum token in stable government currencies

- Lendroid + Digix = Allows users to avail loans against physical assets in any Ethereum token

- Lendroid + Digix + Stabl / Decentralized capital = Allows users to avail loans against physical assets in stable government currencies

and more…

How Lendroid works?

A loan contract itself is pretty straight forward. But then, who fixes the terms of the loan? How do borrowers find and convince lenders? How do we make sure the borrower has the incentive to repay? What happens if the borrower fails to repay? etc

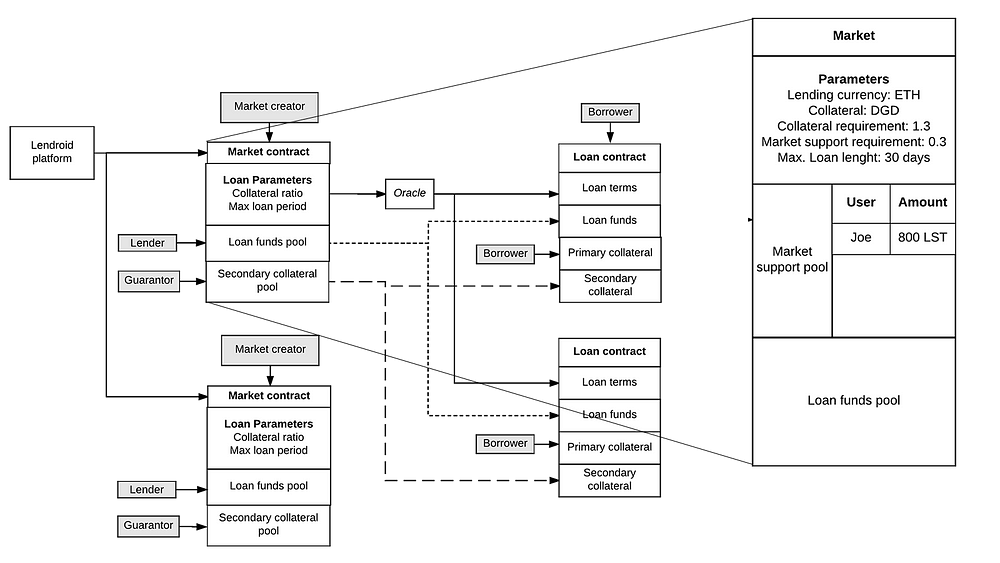

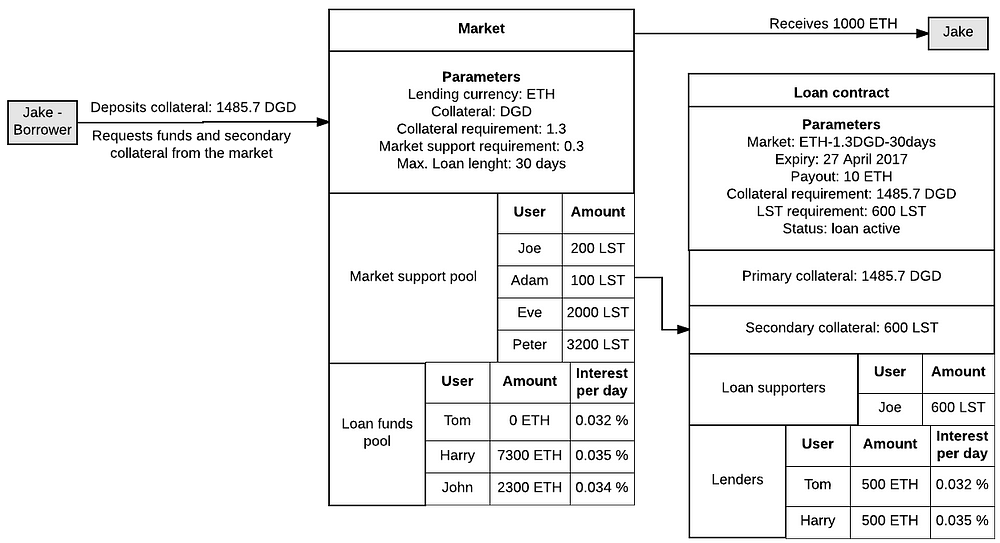

The Lendroid marketplace allows the creation of several loan markets.

Lendroid support tokens(LST) are the native tokens of the Lendroid protocol. Market creators (Lendroid support token holders) propose new markets using a unique set of loan terms (combination of collateral type and ratio).

Lenders and guarantors discover, gather and pre-fund markets which offer loan terms they prefer (terms that they believe will keep the loan solvent, protect their investment and enable them to make money). Guarantors are LST holders who choose to extend support to markets that issue loans that they believe will remain solvent and payout properly, in which case they receive a portion of the interest. If the loan becomes insolvent, they stand to lose their deposit. It is a requirement for every loan to hold LSTs whose value is at least 20% of the borrowed value. The LST deposit acts as secondary collateral for the loan.

Borrowers show up, choose a market depending on the type of collateral they wish to lock, create a loan contract, deposit collateral as defined by the terms of the loan and receive the loan funds.

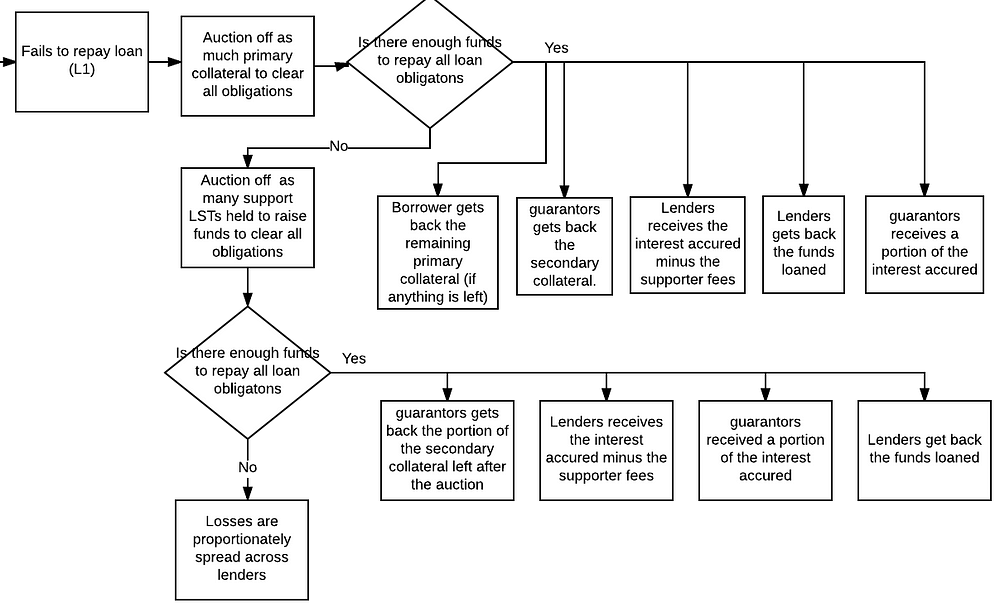

At the end of the loan period, the borrower has the option to extend the loan by adjusting the collateral locked or repay the loan along with the accrued interest, or stands to lose their collateral.

The lenders receive two layers of protection for the funds they lend. One from the value of the primary collateral and another from the value of the secondary collateral. This process increases the confidence of lenders and reduces the lender’s market discovery burden.

It is a great pleasure to be part of the Ethereum community. We hope to continue receiving the support from the community. Let’s build Lendroid together!

A more detailed explaination of the design is available in the whitepaper. Do signup for our newsletter (https://lendroid.com) and make sure you follow us on Twitter (@lendroidproject) and help us spread the word. Please send in your feedback and comments through our slack channel or to connect@lendroid.com, we are waiting to hear from you.

Komentar

Posting Komentar